>What is a Loan Modification?

In Loan Modification - your lender might forgive late fees, give you a better interest rate, switch you from an adjustable rate to a fixed rate, recapitalize missed payments & more! It's hard to believe any lender would be so cooperative - I know. But in light of the current mortgage & foreclosure crisis - lenders are looking for ways to work with borrowers. Essentially, Loan Modification is a way to wipe the slate clean of all missed payments, late fees, etc. and start fresh with the same lender.

>How does Loan Modification work?

As a Home Retention Consultant, I regularly approach homeowners who are behind in their mortgage to see if there is a way to get them back on track. Many times - I actually have a proposed loan modification from the lender. Before doing a loan modification, lenders might ask you to fill out a financial information form. It asks for all kinds of information you probably don't want to provide - current income & expenses, outstanding debts, etc. They want to get a full view of your current financial situation. Here's an example of a recent Loan Modification I delivered:

- Loan would be brought current with lender

- Credit reporting would start reflecting current loan payments

- Interest rate was reduced by 1.25%

- Loan term was changed from an adjustable rate to a 30 year fixed

- Loan balance was increased to reflect missed payments.

- Monthly payment was reduced by 5% - even though the loan amount went up significantly (this property was in the higher end custom market)

- An upfront payment of the new mortgage amount was required as an initial contribution.

- Next payment wasn't due for 1 1/2 months.

The lender will often require one mortgage payment at the time you sign the loan modification agreement. This is a sign of good faith that you can make the payments and will cover some of the late fees, back interest, etc. For most people - this is a good solution. But if you are unemployed, this really doesn't help.

>Will my lender work with me?

A loan modification isn't as common as a forebearance plan, but it's worth asking your lender about. Loan Modifications are regulated by HUD (Housing & Urban Development) - check out the Loan Modification FAQ at HUD. Look on the back of your most recent mortage statement. Yeah, all that tiny print. Each lender usually lists several different phone numbers or departments. Look for something that says loss mitigation or loan workout or home retention. Lenders always have a dedicated department that works with borrowers behind in payments. If all else fails, call the 800# and ask for the loss mitigation department.

>Ask Questions & Do Your Homework

There are many companies out there that will approach you offering to help negotiate with the lender on your behalf. Be careful - some are legitimate and others could be a scam. Most will charge you a months mortgage payment to create a workout - this will be in addition to any upfront money your lender might require. Truth is - you can call the lender yourself and see if they will offer a modification.

>Be Persistent!

You are dealing with large banks with many different departments sometimes spread across different states. People answering the phones have more work than they can handle. It isn't personal. No one is going to have as much incentive to get you a good deal as you are.

If you want more information - keep checking my blog for other Foreclosure Prevention Strategies. If you're uncomfortable doing a loan modification on your own, call me and I'll be happy to help in any way I can. For Free. Why would I do this? If I can help you prevent foreclosure now, I hope you will recommend my services to other people who might need help preventing foreclosure, selling a home or buying a home. It's a win-win situation.

Remember - the worst thing you can do is nothing. Persistence Pays.

Bo Buchanan, Kettley Realtors 58 Chicago Rd, Oswego IL. 60543 (630) 846-4663

IllinoisHouseHunter.com|OswegoHouseHunter.com|MontgomeryHouseHunter.com|YorkvilleHouseHunter.com

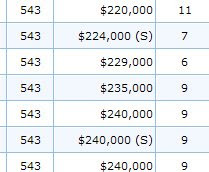

As of March 27th of this year, the MRED LLC, formerly the MLS of Northern Illinois, added a tag to allow REALTORS to identify closed transactions as short sales. The small (S) you see next to the sale price denotes it was a short sale. This is important information for REALTORS, Buyers and Sellers.

As of March 27th of this year, the MRED LLC, formerly the MLS of Northern Illinois, added a tag to allow REALTORS to identify closed transactions as short sales. The small (S) you see next to the sale price denotes it was a short sale. This is important information for REALTORS, Buyers and Sellers.